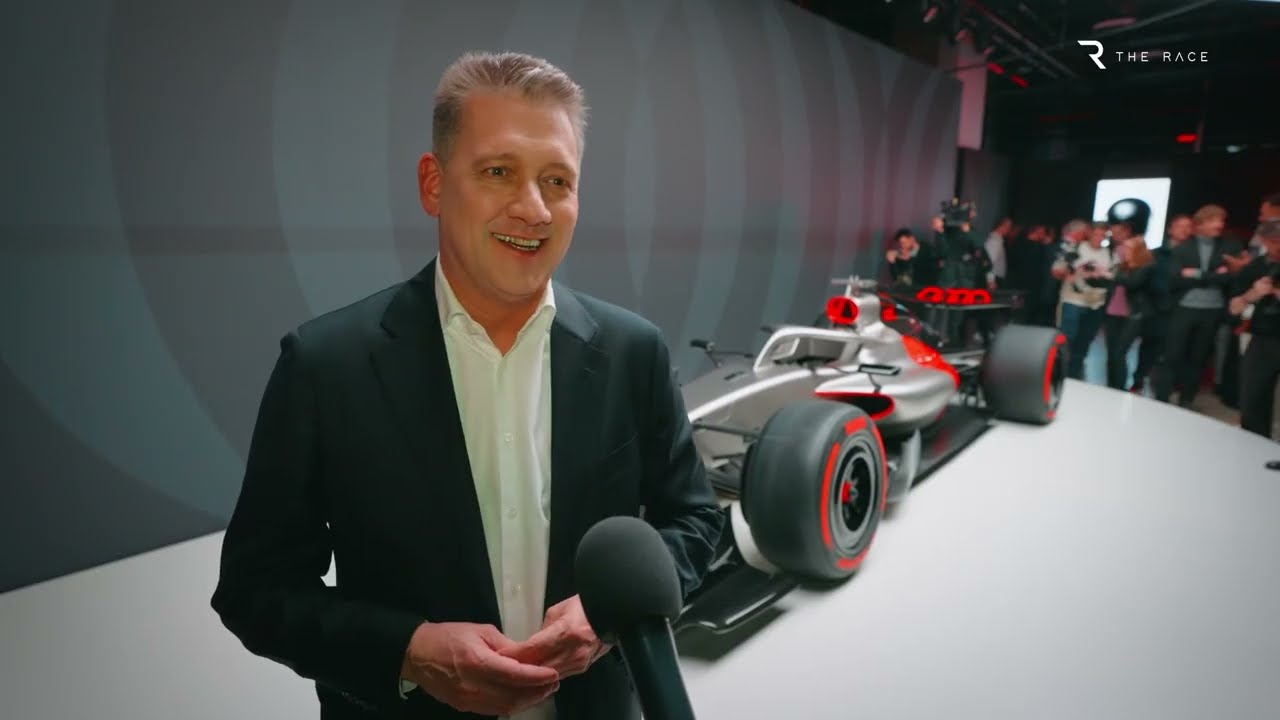

The countdown has officially begun. On January 20th, the eyes of the motorsport world will turn to Berlin for the official launch of the Audi F1 team. It is a moment of monumental significance—the arrival of a German automotive giant to the grid, bearing the weight of a nation’s engineering reputation and the crushing expectations of the Formula 1 paddock. But behind the glossy renders and the corporate optimism lies a story of frantic catch-up, controversial financial maneuvers, and a technical admission that has sent shockwaves through the sport.

As we stand on the precipice of the 2026 season, the question isn’t just whether Audi can win within its ambitious five-year target. The real question is: Can they survive the shark tank they are about to jump into?

The Resurrection: How Sauber Came Back from the Dead

To understand where Audi stands today, we must first look at the ashes from which it has risen. The transition period—the “soft launch” era beginning in late 2022—was, to put it mildly, a disaster.

Between the initial euphoria of the Audi announcement and the gritty reality of the track, the team formerly known as Sauber endured a “pathetic” slump. Across a span of 68 races in the ground-effect era, the team managed a meager 30 points. They were drifting, a “frozen” entity waiting for a German savior that felt increasingly distant. The 2024 campaign was a low point, marred by correlation problems where the wind tunnel data simply didn’t match the reality on the asphalt.

But 2025 changed everything.

In a move that could be the script for a Hollywood underdog movie, Technical Director James Key assembled what he dubbed a “Special Forces” team. This wasn’t a group of veteran superstars, but a squad of roughly ten relatively young, hungry aerodynamicists. Their mission? To save the 2025 car—and by extension, the team’s dignity—while the main workforce focused on the massive 2026 regulation changes.

And they delivered.

A “triptych” of floor developments introduced across the Spanish, Austrian, and British Grands Prix transformed the car. It wasn’t just faster; it was robust. It stopped the dreaded airflow stalls and vortex bursts that had made previous iterations a nightmare to drive. The culmination of this effort was Nico Hülkenberg’s sensational podium at Silverstone in 2025—a moment of pure catharsis that proved this team had not forgotten how to race.

This operational turnaround, spearheaded by the arrival of Jonathan Wheatley as Team Principal and the iron-fisted leadership of Mattia Binotto, has given the project the one thing it desperately lacked: credibility. They are no longer a backmarker meandering aimlessly; they are a team with a pulse.

The Engine Crisis: The “Magic Trick” Audi Missed

However, optimism in Formula 1 is a dangerous drug, and the hangover is often brutal. The most alarming news for Audi fans comes from the heart of the beast: the Power Unit (PU).

Developed at a state-of-the-art facility in Neuburg an der Donau, just a four-hour drive from the chassis base in Hinwil, the Audi engine was supposed to be the jewel in the crown. With a cost cap of $130 million for 2026 (plus extra concessions for newcomers), money wasn’t supposed to be an issue.

But money cannot buy time, and it apparently cannot buy every secret.

Reports have emerged that Audi missed a critical technical “trick” identified by rivals like Mercedes and Red Bull Powertrains. This innovation involves running the engine, when hot, at a compression ratio higher than the intended maximum of 16:1. It’s a piece of engineering wizardry reckoned to be worth several tenths of a second per lap—an eternity in F1.

Mattia Binotto, the man tasked with steering this ship, has been brutally honest. He has stated repeatedly that Audi will not have the best engine in 2026. For a brand synonymous with “Vorsprung durch Technik” (Advancement through Technology), this is a humbling admission before a wheel has even turned in anger.

The team is currently relying on the FIA’s “ADU” (Additional Development and Upgrade) rules as a safety net. If their engine is more than 2% off the pace regarding the “performance index,” they will be granted concessions to catch up. But relying on a rulebook loophole to remain competitive is a precarious strategy for a manufacturer of Audi’s stature.

The Corporate Bloodbath: Jobs vs. Glory

Perhaps the most contentious aspect of Audi’s F1 entry isn’t technical, but moral and financial. The backdrop to this glitzy Berlin launch is a grim reality back home in Germany.

Audi is in the midst of a massive restructuring, with plans to cut 7,500 jobs by the end of 2029. Declining sales, the costly transition to electrification, and “tougher economic conditions” have forced the company to slash over $1 billion in costs.

In this climate, spending hundreds of millions on a “frivolous” activity like Formula 1 looks, to the average observer, like a PR nightmare. How do you justify a new front wing when you are handing out redundancy notices?

The answer lies in a complex web of modern sports finance. Audi has effectively “de-risked” the F1 project to protect it from corporate bean counters.

First, they accelerated their takeover, moving from a planned 75% stake to 100% ownership by early 2024. Then, crucially, they sold a significant minority stake (understood to be around 30%) to the Qatar Investment Authority. This sovereign wealth fund injection provided the cash flow needed to upgrade the Hinwil factory and hit the increased CapEx limits allowed by the FIA.

Add to this a massive title sponsorship deal with fintech giant Revolut—creating the officially named “Audi Revolut F1 Team”—and the healthy prize money from being a constructor, and the project is reportedly “self-sufficient.”

To the board, the F1 team is no longer a cost center; it is an “appreciating asset,” immune to the red pen that is striking through jobs elsewhere in the company. It is a cold, calculated financial logic that ensures the car will race, even as the company shrinks.

The Verdict: A Long Road Ahead

As we approach the 2026 debut, the mood is a mix of relief and trepidation. The “Special Forces” miracle of 2025 proved that the team has the engineering talent to fight in the midfield. The arrival of heavyweights like Wheatley and Binotto has professionalized a chaotic operation.

But the engine deficit is a ticking time bomb. If Audi starts 2026 significantly down on power, no amount of aerodynamic brilliance will save them on the long straights of Jeddah or Monza. And with the corporate wolves circling, patience will be in short supply.

Audi has succeeded in rallying and Le Mans, but Formula 1 is a graveyard for arrogant manufacturers. Just ask Toyota or BMW.

History proves time and again that in F1, promise and potential rarely guarantee performance. Audi has built the factory, hired the staff, and secured the funding. Now, they must do the hardest thing of all: deliver.

The world will be watching on January 20th. But the real test begins when the lights go out. Welcome to the Piranha Club, Audi. Good luck. You’re going to need it.