King Charles’ royal property portfolio, which also includes Royal Lodge from which the monarch attempt to evict his brother, Prince Andrew, hits the headlines again

King Charles’ council bill at Windsor Castle is set to rise by a staggering 25%, it is today reported.

The monarch’s bill will rocket by more than £800 per year if the Government approves Royal Borough of Windsor and Maidenhead’s proposed plans to hugely hike its council tax

It is understood the late Queen paid about £2,300 a year in council tax for Windsor Castle, which is in band H, the highest level, but Charles will have to cough up a further £836. It comes at a time when he intends to downsize the monarchy – and his extensive royal property portfolio.

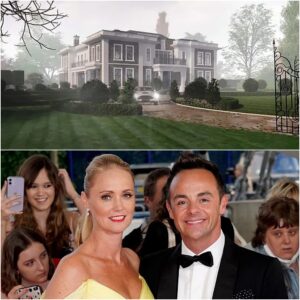

Plans to evict Prince Andrew, 64, from the Royal Lodge, approximately three miles south of Windsor Castle and in the same local authority, derailed when the Duke of York found the necessary funds to retain his keep.

And now the council’s brutal intentions will stretch the Royal Estate’s resources further, with no plans officially afoot to reduce its size. Critics say the Lib Dem-led council could “ruin” household finances with its move. More than 150,000 people live across the patch in Berkshire.

Prince Andrew will stay at the Royal Lodge after finding the money to pay (

Image:

PA)

The local authority, though, is on a financial knife edge as it has admitted to facing “effective bankruptcy”, while warning residents that its draft budget for the 2025-26 financial year includes a “significant increase to council tax bills”.

It has been criticised after asking the government to approve an “exceptional” £60.3 million loan, alongside being able to raise council tax by an additional 20 per cent above the current limit of 4.99 per cent set by the government. If given the green light, this would mean an annual rise of up to £320 for an average band D property the equivalent of £6.15 a week, it said. Windsor residents currently pay about £1,700 a year in council tax for a band-D property.

Speaking to The Daily Telegraph, John O’Connell, the chief executive of the TaxPayers’ Alliance, urged ministers to reject the authority’s request, to “send a message to other councils” that also plan huge tax payments.

Windsor Castle is in the centre of the pictureque Berkshire town (

Image:

BerkshireLive – Grahame Larter)

The Royal Borough of Windsor and Maidenhead told The Times the “significant increase to council tax bills” was needed to “enable the council to set a balanced budget and deliver the services residents need to undo years of cuts and underfunding; the council is on the brink of effective bankruptcy”.

One in four councils expects to declare themselves effectively bankrupt in the next two years as revenues fail to keep up with the rising cost of children’s and adult social care services.

Windsor and Maidenhead added that the “unsustainable low level of council tax income compared to most other authorities, due to historic decisions to cut council tax year after year over a sustained period from 2010, combined with high levels of debt, means it doesn’t have the financial resilience to meet these pressures”.

The proposed rise will be subject to public consultation, with results reported in February, before the budget is put to full council for a vote in March.